(all quotes from the book are in BOLD)

There are many rudimentary points mentioned in this book which are invaluable to any trader. Martin "Buzzy" Schwartz has given thorough details about his trading life. Also, he has given much insight into the reasons for his losing and winning trades. I will summarize information which I have found helpful. This is a book which should be read many times during a trader's career, especially if you have suffered a setback.

Martin always wanted to be a trader. His wife of 4 months, Audrey, told him to become a trader at age 33.

Martin was good at math, loved gambling and the market. He wrote down BECOME A TRADER. (his goal)

He then wrote a plan DEVELOP A METHODOLOGY FOR TRADING THAT FITS MY STYLE.

ACCUMULATE A GRUBSTAKE OF $100,000.

He set a time frame WITHIN ONE YEAR

He needed a mentor MAKE ZOELLNER MY MENTOR.

GET A SEAT ON SOME EXCHANGE.

TAKE A SABBATICAL.

He started trading Call options. He broke even the first two years. And then began making consistent money.

YOU HAVE TO PROVE YOUR ABILITIES AND TEST YOUR METHODS BY ACTUALLY TRADING, AND MAKING REAL MONEY, BEFORE YOU DEPEND ON TRADING FOR YOUR LIVELIHOOD

He borrowed $50,000 after saving $50,000 for his grubstake.

He was a securities analyst for 9.5 years before he quit to become a trader.

What he learned from playing craps:

DIVORCE YOUR EGO FROM THE GAME

MANAGE YOUR MONEY

CHANGE TABLES AFTER A WINNING STREAK (periodically deposit your winnings)

...mental discipline may not make you a winner in the market , but if you don't have it, you're sure to be a loser.

In 1981 he made $1.2 million trading options in mainly one stock, ASA.

In 1982, he began trading S&P futures. His trading edge for trading S&P futures was by watching bond futures.

At age 37, he became a multimillionaire.

Luck? You bet it was luck. but it was also intellectual because I worked so hard at it.

Going short's a game for the pros.

He lost $800,000 on a short S&P futures trade. But ended down only $57,000 for the same month.

...thanks to Audrey and Zoellner (his mentor), I'd realized my mistake and got beyond it.

The best way to end a losing streak is to cut your losses and divorce your ego from the game.

Stop trading, take time to recover and start trading small.

...concentrate on being profitable. DON'T START BY TRYING TO MAKE A KILLING.

CONFIDENCE IS ESSENTIAL TO A SUCCESSFUL TRADER.

Losing streaks are an unfortunate part of the game, but if you are a good disciplined trader who can shift into neutral, the losing will end and black ink will start to flow again.

He won the U.S. Investing Championships in 1983 with a 175.3 percent return. Over a 4 month period he parlayed his $482,000 stake into $1.2 million. In the next contest he posted a 443.7 percent return, beating 262 entrants.

One of the great tools of trading is the stop, the point at which you divorce yourself from your emotions and ego and admit that you're wrong.

EXITING A LOSING TRADE QUICKLY CLEARS YOUR HEAD AND RESTORES YOUR OBJECTIVITY.

By preserving your capital through the use of a stop, you make it possible to wait for a high-probability trade with a low-risk entry point.

According to his friend Mark Cook:

to be a successful trader you have to have a complete commitment to trading and do it full-time.

...fit your trading habits to your personality. Know you emotional weaknesses

...planning is the objective part of trading.

You have to have natural skills, but you have to train yourself on how to use them.

Break the pressure before it breaks you.

WHEN YOU'RE IN A LOSING POSITION AND YOU'RE BRAINLOCKED, DO WHATEVER'S NECESSARY TO HELP CLEAR YOUR HEAD.

I've learned through the years that after a good run of profits in the markets, it's very important to take a few days off as a reward.

KEEP YOUR BALANCE.

Hard work is the primary reason why I've become so successful, but hard work's just part of the equation. By nature, I'm a gambler with a good feel for numbers, and , as I've mentioned before, Amherst taught me how to think, Columbia Business School taught me what to think about, the Marine Corps taught me how to perform under fire, and Audrey taught me the importance of money management.

Listening to what the market is saying takes extreme concentration.

There is an entire chapter titled "The Pit Bull's Guide to Successful Trading." I recommend reading it.

... the most important change in my trading career occurred when I learned to DIVORCE MY EGO FROM THE TRADE. Trading is a psychological game.

You have to stop trying to will things to happen in order to prove you're right. Listen to what the market is telling you now. Forget what you thought it was telling you five minutes ago.

What I like most about this book is that Martin Schwartz did not need to write this book for the money. I have read short interviews about traders. But this book hits home because it details the entire journey of a highly successful trader, one of the Market Wizards.

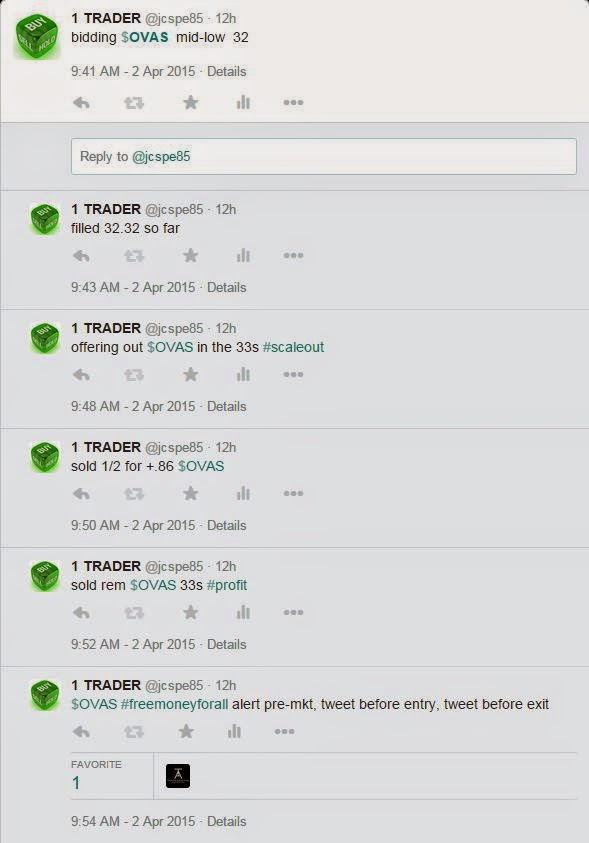

1trader