Trading Trader Stocks Equities Options Futures Rules Tips Lessons Education Psychology NASDAQ NYSE GLOBEX Global Macroeconomics

Search This Blog

Wednesday, June 10, 2015

Shorting Gapped-Up stocks before/after the open

Before shorting gapped up stocks at the open, you should already be familiar with day trading short.

Here are considerations when shorting stocks that gap up Pre-Market:

There needs to be signifigant volume Pre-Market or AH the prior day for a gapped up, short trade to potentially work. In other words, the catalyst has to force a squeeze of existing shorts and/or create buying panic.

Pre-market direction is difficult to judge. 90% of the time I close or reduce my pre-mkt short trade before the open and then re-short after the open(even if I get filled at a worst price).

If you are unfamiliar or uncomfortable with thin, pre-market trading conditions, then don't trade short during pre-market.

Reduce trading size until you are consistent.

Intraday volatility is normally highest at the open. Spreads become wide. So, you must allow for wiggle room. And if you are wrong, i.e. squeezed, expect to lose more money than usual.

Always scale-in. Increase exposure upon confirmation. On some trades, confirmation usually occurs when the opening range is broken. Realize there will be many sell orders, likely market orders, following the break of the opening range. On other trades, initial shorts are squeezed to a higher price before the actual stock price decline begins.

Level of shorting difficulty for gapped up stocks, from most difficult to least difficult: momentum based, earnings beat, news and analyst upgrades.

Momentum based shorts which move due to popularity, for ex. Ebola stocks or body camera stocks, are difficult to short if the float has been traded several times over during the previous day. Other recent stocks which fall into this category include PBMD and VLTC. Avoid shorting these stocks until you have an advanced ability in market timing. Better to trade these stocks on the long side.

Stocks which gap up due to strong earnings will potentially be a long trade after a morning decline, particularly if the stock is trading at new highs.

Wednesday, May 06, 2015

excellent article on Revenge Trading: Trying to Recover Losses Back

Before you read this... realize this information pertains more to beginning-intermediate traders. Stocks like $PTBI $VLTC $ICLD, which I recently traded, have difficult to spot trends/pivot points. Plus, when the float is traded 2X, 3X or more in one day, there is a high likelihood of being squeezed if you are short. Until you have a built up mental resistance to drawdowns along with trading experience, these trades should be done with reduced size or possibly not done at all.

No reason to cut your teeth in trading difficult stocks or difficult strategies.

When I do tweet a trade in this type of stock, it is likely that I have found a better (for lack of correct adjective) entry point to short. So I will tweet the trade. However, the risk to get squeezed is still there.

Remember, some traders, usually ones with greater experience, ability and deeper pockets, can turn around the next day from a loss and trade at 100%, with a clear mind. However, this ability is not something that can be attained easily, likely not in the first year or two of trading. Most traders should recoup from the psychological damage from a large loss before continuing trading. I recommend reducing trade size or taking a break first, if you are not an advanced trader.

=======================================================

The article below is written about the 'angry trade' but even if you are not angry, the same scenario and outcome could result due to your damaged mental state.

From http://www.financial-spread-betting.com/strategies/revenge-trading.html

The ‘angry trade’ is the worst possible trade you can make. It’s usually done after a loss with a desire to get your own back, or more specifically to win back the money you’ve just lost.

There are several reasons it’s so bad:

1) It’s often not planned out properly. Whereas your first trade may have been carefully planned and may actually have been a sensible trade that just went wrong, more often than not the trade following it is an unplanned one that’s done in a hurry. More often than not it’s no better than gambling. You do it in such a hurry to win back your losses that you haven’t properly considered exit points and analysed the risk.

2) Quite often it’s a larger bet than the first one because you’re so desperate to win back what you’ve just lost that you want to do this as quickly as possible. And the quickest way to do this (according to your logic at the time) is to raise your stake size. Again, you’ve completely ignored the risk.

3) It’s an emotional trade that’s done for the wrong reasons. Your emotions have so overcome your normal rational decision making process that it’s quite likely that you’ve not factored in all sorts of other potential pitfalls (e.g. long-term support or resistance that you might be trading against).

The problem with the angry trade is that it often starts off a spiral. If it wins great, but the problem here is you’ve effectively won by gambling, and you might try to repeat that win by gambling again, without using anything more than gut instinct. This goes against all the rules of trading and will result in you eventually blowing your account. If it loses, as it’s more likely to do, then you’ve effectively dug yourself even deeper into the hole you were just in. This then results in an even angrier trade, and so on, leading to desperation and seriously increasing the chances of blowing everything in a short space of time.

Ask yourself, what caused this angry trade in the first place? Why were you so desperate to win back what you’d just lost?

The chances are that, although the first trade may have been a good one that didn’t work out, you hadn’t correctly mentally accepted the risk before you went into the trade. You may also have been trading too large a stake. A good technique is, before placing a trade, to always assume that it’s going to be a loser. Work out your risk this way. How much are you willing to lose on the trade? You need to see it in the long term perspective as a proportion of the capital that you’ve set aside for trading. This way, if it does lose, you’ll be ready for it. You will only have lost a small proportion of your capital (it shouldn’t really be any more than 2%) and you’ll better be able to deal with it. Then you simply have to try to forget about it. Do not let it affect your next trade. This is the hardest part and what divides the winners from the losers. If necessary, take some time out for example, don’t trade for another 24 hours – until you’re convinced that you’re in an unemotional state of mind that will make sure that your next trade isn’t an angry one – ie that it’s taking advantage of a beneficial opportunity (not just trading for the sake of it), that it’s properly planned out, and that you’ve properly calculated your stake size based on your risk limits.

This is another of those incredibly important lessons that you’ll do well to heed. Just remember, next time you have a loss, just stop. Accept that the money’s gone and that the next trade you make will be on its own merits, completely unconnected from the last one. This way and this way only will you progress from being a loser to being a winner.

Monday, April 20, 2015

Book Review of Pit Bull, Lessons from WALL STREET'S Champion Trader

(all quotes from the book are in BOLD)

There are many rudimentary points mentioned in this book which are invaluable to any trader. Martin "Buzzy" Schwartz has given thorough details about his trading life. Also, he has given much insight into the reasons for his losing and winning trades. I will summarize information which I have found helpful. This is a book which should be read many times during a trader's career, especially if you have suffered a setback.

Martin always wanted to be a trader. His wife of 4 months, Audrey, told him to become a trader at age 33.

Martin was good at math, loved gambling and the market. He wrote down BECOME A TRADER. (his goal)

He then wrote a plan DEVELOP A METHODOLOGY FOR TRADING THAT FITS MY STYLE.

ACCUMULATE A GRUBSTAKE OF $100,000.

He set a time frame WITHIN ONE YEAR

He needed a mentor MAKE ZOELLNER MY MENTOR.

GET A SEAT ON SOME EXCHANGE.

TAKE A SABBATICAL.

He started trading Call options. He broke even the first two years. And then began making consistent money.

YOU HAVE TO PROVE YOUR ABILITIES AND TEST YOUR METHODS BY ACTUALLY TRADING, AND MAKING REAL MONEY, BEFORE YOU DEPEND ON TRADING FOR YOUR LIVELIHOOD

He borrowed $50,000 after saving $50,000 for his grubstake.

He was a securities analyst for 9.5 years before he quit to become a trader.

What he learned from playing craps:

DIVORCE YOUR EGO FROM THE GAME

MANAGE YOUR MONEY

CHANGE TABLES AFTER A WINNING STREAK (periodically deposit your winnings)

...mental discipline may not make you a winner in the market , but if you don't have it, you're sure to be a loser.

In 1981 he made $1.2 million trading options in mainly one stock, ASA.

In 1982, he began trading S&P futures. His trading edge for trading S&P futures was by watching bond futures.

At age 37, he became a multimillionaire.

Luck? You bet it was luck. but it was also intellectual because I worked so hard at it.

Going short's a game for the pros.

He lost $800,000 on a short S&P futures trade. But ended down only $57,000 for the same month.

...thanks to Audrey and Zoellner (his mentor), I'd realized my mistake and got beyond it.

The best way to end a losing streak is to cut your losses and divorce your ego from the game.

Stop trading, take time to recover and start trading small.

...concentrate on being profitable. DON'T START BY TRYING TO MAKE A KILLING.

CONFIDENCE IS ESSENTIAL TO A SUCCESSFUL TRADER.

Losing streaks are an unfortunate part of the game, but if you are a good disciplined trader who can shift into neutral, the losing will end and black ink will start to flow again.

He won the U.S. Investing Championships in 1983 with a 175.3 percent return. Over a 4 month period he parlayed his $482,000 stake into $1.2 million. In the next contest he posted a 443.7 percent return, beating 262 entrants.

One of the great tools of trading is the stop, the point at which you divorce yourself from your emotions and ego and admit that you're wrong.

EXITING A LOSING TRADE QUICKLY CLEARS YOUR HEAD AND RESTORES YOUR OBJECTIVITY.

By preserving your capital through the use of a stop, you make it possible to wait for a high-probability trade with a low-risk entry point.

According to his friend Mark Cook:

to be a successful trader you have to have a complete commitment to trading and do it full-time.

...fit your trading habits to your personality. Know you emotional weaknesses

...planning is the objective part of trading.

You have to have natural skills, but you have to train yourself on how to use them.

Break the pressure before it breaks you.

WHEN YOU'RE IN A LOSING POSITION AND YOU'RE BRAINLOCKED, DO WHATEVER'S NECESSARY TO HELP CLEAR YOUR HEAD.

I've learned through the years that after a good run of profits in the markets, it's very important to take a few days off as a reward.

KEEP YOUR BALANCE.

Hard work is the primary reason why I've become so successful, but hard work's just part of the equation. By nature, I'm a gambler with a good feel for numbers, and , as I've mentioned before, Amherst taught me how to think, Columbia Business School taught me what to think about, the Marine Corps taught me how to perform under fire, and Audrey taught me the importance of money management.

Listening to what the market is saying takes extreme concentration.

There is an entire chapter titled "The Pit Bull's Guide to Successful Trading." I recommend reading it.

... the most important change in my trading career occurred when I learned to DIVORCE MY EGO FROM THE TRADE. Trading is a psychological game.

You have to stop trying to will things to happen in order to prove you're right. Listen to what the market is telling you now. Forget what you thought it was telling you five minutes ago.

What I like most about this book is that Martin Schwartz did not need to write this book for the money. I have read short interviews about traders. But this book hits home because it details the entire journey of a highly successful trader, one of the Market Wizards.

1trader

Thursday, April 02, 2015

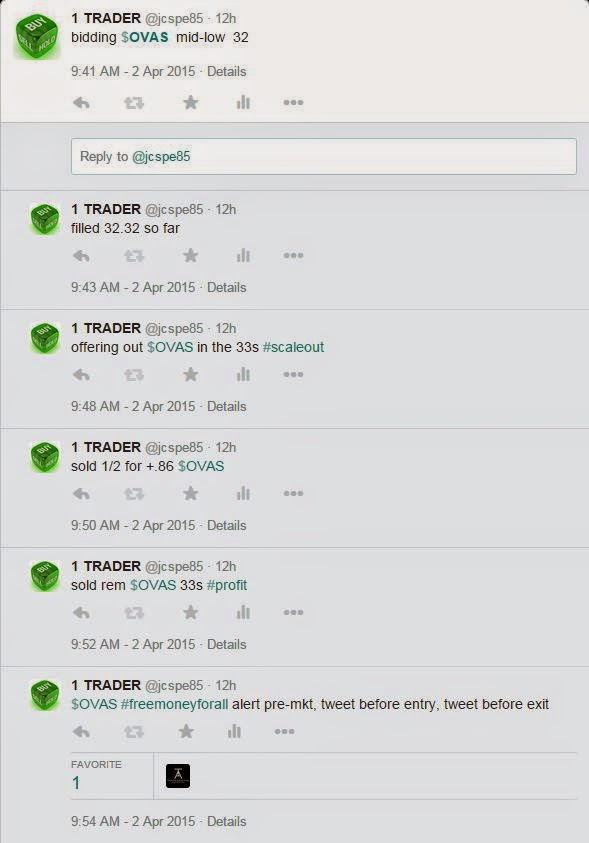

The Art Of The Trade OVAS April 2 2015

How I traded $OVAS today

Time is for tweets in EST. Highlighted tweets were tweeted prior to activity.

9:16 $OVAS #watch long (identified stock as long trade pre-mkt)

9:19 noted pre-mkt volume as 175 shares total (very weak)

9:32 bid for stock, bought 32.46 avg (no tweet)

9:37 scalped 1.19 $OVAS #profit (sold 33.27 avg)

9:41 bidding $OVAS mid-low 32 (before the entry)

9:43 filled 32.32 so far (initial buy trade)

9:48 offering out $OVAS in the 33s #scaleout (before the exit)

9:50 sold 1/2 for +.86 $OVAS

9:52 sold rem $OVAS 33s #profit

10:00 bid for $OVAS mid 32s again (no tweet)

10:58 $OVAS vol getting thin... out of last long scalp now 33.5s

(sold for 1.04 avg 3rd trade)

11:17 will wait for $OVAS to pb closer to 33 before buy #swing

(stock was trading 34s but identified potential for PB)

11:33 went long at new hod but exited trade for small scalp (no tweet)

11:41 stock fails to recover after breaking below area after new highs (no tweet)

11:43 for next 10 minutes, shorted stock 33.9s (no tweet)

12:22 stock hits 33 and I begin to cover +.91, also going long as noted before on 11:17 tweet (no tweet)

1:18 $OVAS up it goes

1:57 sold all $OVAS from 33 #profit (filled 34.7s - 34.8s)

2:05 +1.81 avg on all $OVAS (prev trade profits)

2:09 stock trades new hod, I buy back small, 35 avg, observed heavy buying (no tweet)

2:14 $OVAS long sm sz fwiw at 35

2:15 $OVAS will offer 35.4+ to sell (tweet before exit)

2:17 sold 35.4s for .42 (no tweet)

2:18 noticed extreme chop in stock, did smaller sz trades for next hour

very choppy channel trading (no tweet)

2:46 Will buy and hold $OVAS for #swing before eod (wanted to re-buy

when day traders exit, thinking possible break below 35)

3:20 sell stops hit at 35, bids drop for the next 3 minutes, large prints

hit the tape at 3:23, observed bid holding 34.60 so I entered trades (no tweet)

3:35 long 10k $OVAS 34.62 avg ST #swing

NOTE: MACD is just a guide. This indicator is based on trailing data. Thus MACD trend lines displayed are not to be interpreted as a leading indicators. I only use MACD in hindsight to confirm what I saw on the tape.

Saturday, March 21, 2015

Twittertainment vs Reality, the true trolls of Twitter

https://www.sec.gov/litigation/litreleases/2009/lr21053.htm

Nathan Michaud @investorslive investigated by the SEC for penny stock manipulation. investorsunderground.com investors underground investorslive nathanmichaud.com

https://www.goodetrades.com/2012/01/penny-stock-trader-nate-michaud-settles-with-sec-in-pump-dump-case/

" I do believe that he is guilty of impropriety in the case he settled with the SEC" - Michael Goode @goodetrades

http://lasvegassun.com/news/2009/may/21/sec-las-vegas-companys-stock-manipulated-profits/

"Nathan M. Michaud of Boston, said to be a web site designer."

My use of Twitter is a combination of 99% business and 1% entertainment . I created the @jcspe85 Twitter account to detail my daily trading thoughts and activities. My trades are not to be taken as recommendations. However, my trade selection and my trading process are meant to show how someone with >30 years of trading experience, most as a professional trader with FINRA licenses, goes about the daily business of trading stocks, options and futures.

My twitter feeds and this blog are 100% FREE. I don't get compensated by Google Ad Sense for this blog, so I don't receive advertising money. I recommend books but I have no links to Amazon, so no money from referrals.

In the trading world, worthwhile help is unheard of... especially if it is free. I am thankful for some of the information provided by people in the Twitter trader community. Much of my research time is shortened because I find my answers on Twitter. My trading business requires at least 10 hours a day to do properly. So, during most days, I don't have time to respond to questions right away. And I am limited to how I much I can answer via Twitter's direct messaging system. Recently I have taken about an hour each day to respond to DM questions during After Hours, a total of 20-25 hours per month. Many people have asked me to be their trading mentor but I simply cannot do it at the moment because of time constraints. Just like any other trader, I need down time to relax, exercise and refocus, not to mention to have a personal life. I love trading but trading can become a disaster if you allow it to consume your life.

I am a proponent of paid trading services such as chat rooms, courses and coaching sessions. Its far better and cheaper to learn from experienced traders than to lose money making your own mistakes. I was lucky to have a professional trading career to pay for some of my education. I have used paid subscription services in the past. But mostly, my learning came from books and on-the-job training.

As noted in a prior blog post, I have intentions of providing paid services, one day.

This leads me to the reason I am composing this blog today, Twittertainment vs Reality. I enjoy the entertainment of jokes and photos and what not from other Twitter folks. It breaks up the monotony during the down time of the day. My tweets are about actionable trades. So I leave the Twittertainment to others.

The reality of Twitter is that the more famous you become, the more the trolls come after you. Accordingly, I have had to post a Twitter policy to let followers know my zero tolerance policy of trolling. I have and will curtail all trolling activity towards me by an immediate block. Its not a reflection of who I am BUT I cannot allow the shenanigans of haters to affect my mood, and even more so, my trading performance. Its hard to distinguish the haters from the good people sometimes. So if I accidentally blocked you, then email me or comment on this post for an unblock.

If you have been following my Twitter feed this week, you may have noticed that several ex-followers(I blocked all I could find) on Twitter, many associated with Investors Underground chat, have decided to slander and ridicule me on Twitter, beyond normal jokes or occasional sarcasm. For the most part I have ignored unruly and childish people. Its not my nature to reply to haters, but some of these individuals I have helped numerous times with trading questions, especially @Modern_Rock, the biggest cheerleader of Investors Underground chat. I don't know MR's real name and we have never met in person.

At 1:17 a.m. Thursday morning I created a new blog post, 10 Strict Guidelines For Traders, while trading futures. Realize I was doing something to help traders who read my blog AFTER midnight. I edited the content of a trading related article I read on the internet. I customized the content to reflect my interpretation of day trading. Most of the information on the article was spot on, but I added the most important concept in guideline no. 10. Also, I removed numerous, impertinent sentences and paragraphs. All in all, less than half of the article was used. I released it to the public without proofreading in entirety. I always re-edit blogs after I post anyway and had intended to look over it the next chance I got. It was late, I set my stops on my futures trades and went to sleep at 1:20 a.m.

Later, Thursday morning, about 1-hour prior to market open, @Nikkorico_ of IU chat tweeted to me about not posting the editorial credit for the article. It took me less than a minute to update with a credit reference to my blog post. I had previously referenced material on this blog before. My blog posts are not being quoted, nor published for profit, nor used to attract paying subscribers. Why should this be of any concern, regarding a free blog post, for anyone to alert me via Twitter? But then several other, new IU chat members replied to @Nikkorico_ 's tweet. For the most part I thought these actions were odd. Why didn't @Nikkorico_ email me or just comment on my blog? I have never conversed with @Nikkorico_ before. He could have used the email contact for this blog or have commented at the bottom of the post. Minutes later @InvestorsLive joined the conversation. I have never met anyone in person from IU chat, nor do I know @InvestorsLive, Nathan Michaud, founder of IU chat. Nathan had tweeted me once before, but he doesn't follow me. I received over 10 tweets in a span of 30 minutes before the market open. Incidentally, their troll tweets were deleted in order to hide the evidence.

The trolling attack continued throughout the day. A few trolls I had blocked from the past also joined in. I blocked more than 30 people that day.

The following day, Friday, more trolls, including @michiganwar @PsychoOnWallST @parabol128 @swedepilot, decided to pick on my Twitter-related Instagram account. I created @jcspe85 in February 2015 to generate awareness of my Twitter account and blog. More IU chat members and @Nikkorico_ and @Modern_Rock re-tweeted the same tweets. @jcspe85 is/was not my personal Instagram account. How do photos of what I drive, what I eat, where I travel to, lend credibility to my trading aptitude? Trading profits have rewarded me well. I deleted the Instagram account and blocked more trolls.

It is obvious certain IU members felt threatened by my growing popularity on Twitter. Perhaps now my popularity is at a point where Nathan Michaud felt I would encroach on his subscription service. I don't charge a cent and I provide actionable and helpful content on Twitter. I must be considered to be a business threat by Nathan Michaud.

Nathan Michaud is a hypocrite.

In summary, I want everyone to be aware of this unscrupulous activity. The lies and exaggerations that were made to discredit me failed. But if it does get worse, I will contact my attorney in regards to a defamation lawsuit. For the record, I have saved their deleted tweets via Tweetcaster, an app on my phone.

Below are the related tweets from the same people who call out other trolls on Twitter.

*****************************************

@InvestorsLive and @modern_rock joined in. On a trading day at the busiest time, at the open, both tweeted simultaneously for 30 minutes straight. Afterwards, both deleted their tweets to hide their accountability.

Here is the first tweet ever from @InvestorsLive to me concerning his opinion about me. @Str8yaknees was someone I blocked on Feb 5th.

I attempted to defuse the situation.

This was Nathan's final tweet. He blocked me but I never followed him. How does a tweet responding to @Nikkorico_ count as "lost all respect"? Go figure.

With the incriminating judgement from the SEC, is Nathan Michaud in the position to make any character judgement calls?

*******************************************

Does MR consider himself to be the judge on the Twitter trader court? LOL And if you block MR, he will assume the worst. Does he want to be the Big Man On Campus among IU traders? He is more like the Court Jester of Jokes and Trolls.

I wrote a joke tweet with LOL and later MR misleadingly interpreted it as a comparison.

Later in the evening 8:55 PM MR tweeted another false accusation. He used the words "scandal" "caught" "trying to pass" "plagiarism". I had held off blocking him until this point.

Again, MR asked for screenshots when I have tweeted and blogged that I don't post screenshots. MR again deleted his tweets afterwards.

When IU chat members troll together...

I have screenshots of other IU chat members' tweets who have praised my trading ability, even #FF, before this occurred. Some IU chat members are unlike this. I have helped all who have asked.

The important lesson here is BEWARE of @Nikkorico_ @InvestorsLive @Modern_Rock @michiganwar @PsychoOnWallST @parabol128 @swedepilot Investors Underground chat members.

Respectfully,

1 Trader

© 1 Trader and jcspe85.blog.com, 2015.

Thursday, March 19, 2015

10 Strict Guidelines For Day Traders

This trading guide is for day traders.

- You will not be a scalper. Until you are highly experienced at tape reading, avoid scalping. Even then scalping should be minimal because it distracts from trading larger moves. Plus, the smaller moves place you in competition with computerized trading, i.e. HFT programs. You cannot defeat computerized trading.

- You will be a selective day trader. The right kinds of market conditions are not present for every trade, and it is psychologically demanding to day trade every minute, day in and day out. One tremendous advantage you have is freedom of choice, you do not need to take every signal or trade every market. You do not need to be in a position before a FED moment or trade every news announcement. You have the luxury to wait and watch and witness the market’s reaction before taking action. If a market is "newsless" and quiet, or range bound, you can always relax and let your most important quality—patience—work for you. Less is more. Master one style first.

- You will treat day trading as a business. It is not a part-time diversion. It is very demanding. You need total focus and total concentration. To be totally focused you must eliminate outside distractions. Lock your door if you have to. I know from personal experience, the more outside annoyances, the harder it is for me to trade effectively.

- You will feel good. If you do not feel well, you cannot day trade effectively. If you stayed out late last night drinking or are physically ill or have emotional stress from outside influences, you should not do any kind of trading and this is especially important when day trading. Day trading is much more demanding and it is absolutely essential you be sharper and quicker than your competition. When the optimal "set-up" presents itself, you must feel strong, because you will not have the luxury of hesitation!

- You will be totally disciplined! What this means is you will follow written and well-defined rules systematically, which is the only way to avoid the emotionalism of the markets. In other words, you will construct a game plan, which you will follow without bias. Let me repeat this, you will have NO biases. (I have always had bigger losses when I have had a strong opinion and overruled my technical game plan.) If you do not follow your game plan, you will miss some of the best and most profitable trades. What will your game plan look like? It will have well defined entry and exit rules. It will be well thought out where you will not be stopped out too often. It will be flexible according to changing market conditions. It will tell you when to stop trading. Your rules will be very strict in terms of capital preservation, especially during drawdown periods. Personally, I will not tolerate a drawdown of greater than a certain fixed amount in any single day or any single trade. Total discipline means you will always use stops (just do it), and never cancel a stop just because the market is getting close to it. Finally, never add to a losing position. Trade what you see.

- You will never let a decent profit turn into a loss. Here is what I do: if I have a reasonable profit on paper, I move my stop up so that, if half of these profits slip away, I am out of the position. The reason is obvious; in this way you escape with at least a portion of your profits.

- You will become very cautious after a "Home Run." After you make a big hit, the temptation to overtrade grows geometrically. After a home run, look for singles (reduce size or better yet, take time off).

- You will go only where the action is. It is essential to be aware of the current trading environment. Day trading requires volatility and liquidity in the right stock. Not all markets are volatile enough to allow for ranges required for consistent profitability; you need a market that not only moves, but moves within a limited time frame.

- You will day trade only markets suited to you. Not every market is suited to everyone and there is no rule that says you have to trade anything and everything. For day trading, I like stocks, options, the S&P futures and crude oil futures.

- You will understand that greater confirmation means you will enter the trade later than sooner. Most of the time I will begin with a starter position and add upon increased confirmation.

*** This content is edited and modified from an article by George Kleinman. The author has been contacted in regards to this post.

http://www.crbtrader.com/trader/v10n01/v10n01a01.asp

http://www.crbtrader.com/trader/v10n01/v10n01a01.asp

© 1 Trader and jcspe85.blog.com, 2015.

Tuesday, March 03, 2015

50 Rules and More From Linda Raschke

Linda Raschke is someone I have read about since the late 80s. Here are some of her quotes...

“The truth is that once you get down on the trading floor, you find that the traders come from all walks of life. You don’t have to be a rocket scientist to be a trader. In fact, some of the best traders whom I knew down on the floor were surf bums. Formal education didn’t really seem to have much to do with a person’s skill as a trader.”

“I’m also a firm believer in predicting price direction, but not magnitude. I don’t set price targets. I get out when the market action tells me it’s time to get out, rather than based on any consideration of how far the price has gone. You have to be willing to take what the market gives you.”

“I really value the fact that I’ve learned to trade as a craft. Like any craft, such as piano playing, perfection may be elusive – I’ll never play a piece perfectly, and I’ll never buy the low and sell the high – but consistency is achievable if you practice day in and day out.”

“I truly feel that I could give away all my secrets and it wouldn’t make any difference. Most people can’t control their emotions or follow a system. Also, most traders wouldn’t follow my system, even if I gave them step-by-step instructions, because my approach wouldn’t feel right to them.”

“Understand that learning the market can take years. Immerse yourself in the world of trading and give up everything else. Get as close to other successful traders as you can. Consider working for one for free.”

Learn the following rules. Imagine if you followed this daily.

1. Plan your trades. Trade your plan.

2. Keep records of your trading results.

3. Keep a positive attitude, no matter how much you lose.

4. Don’t take the market home.

5. Continually set higher trading goals.

6. Successful traders buy into bad news and sell into good news.

7. Successful traders are not afraid to buy high and sell low.

8. Successful traders have a well-scheduled planned time for studying the markets.

9. Successful traders isolate themselves from the opinions of others.

10. Continually strive for patience, perseverance, determination, and rational action.

11. Limit your losses – use stops!

12. Never cancel a stop loss order after you have placed it!

13. Place the stop at the time you make your trade.

14. Never get into the market because you are anxious because of waiting.

15. Avoid getting in or out of the market too often.

16. Losses make the trader studious – not profits. Take advantage of every loss to improve your knowledge of market action.

17. The most difficult task in speculation is not prediction but self-control. Successful trading is difficult and frustrating. You are the most important element in the equation for success.

18. Always discipline yourself by following a pre-determined set of rules.

19. Remember that a bear market will give back in one month what a bull market has taken three months to build.

19. Remember that a bear market will give back in one month what a bull market has taken three months to build.

20. Don’t ever allow a big winning trade to turn into a loser. Stop yourself out if the market moves against you 20% from your peak profit point.

21. You must have a program, you must know your program, and you must follow your program.

22. Expect and accept losses gracefully. Those who brood over losses always miss the next opportunity, which more than likely will be profitable.

23. Split your profits right down the middle and never risk more than 50% of them again in the market.

24. The key to successful trading is knowing yourself and your stress point.

25. The difference between winners and losers isn’t so much native ability as it is discipline exercised in avoiding mistakes.

26. In trading as in fencing there are the quick and the dead.

27. Speech may be silver but silence is golden. Traders with the golden touch do not talk about their success.

28. Dream big dreams and think tall. Very few people set goals too high. A man becomes what he thinks about all day long.

29. Accept failure as a step towards victory.

30. Have you taken a loss? Forget it quickly. Have you taken a profit?

Forget it even quicker! Don’t let ego and greed inhibit clear thinking and hard work.

Forget it even quicker! Don’t let ego and greed inhibit clear thinking and hard work.

31. One cannot do anything about yesterday. When one door closes, another door opens. The greater opportunity always lies through the open door.

32. The deepest secret for the trader is to subordinate his will to the will of the market. The market is truth as it reflects all forces that bear upon it. As long as he recognizes this he is safe. When he ignores this, he is lost and doomed.

33. It’s much easier to put on a trade than to take it off.

34. If a market doesn’t do what you think it should do, get out.

35. Beware of large positions that can control your emotions. Don’t be overly aggressive with the market. Treat it gently by allowing your equity to grow steadily rather than in bursts.

36. Never add to a losing position.

37. Beware of trying to pick tops or bottoms.

38. You must believe in yourself and your judgement if you expect to make a living at this game.

39. In a narrow market there is no sense in trying to anticipate what the next big movement is going to be – up or down.

40. A loss never bothers me after I take it. I forget it overnight. But being wrong and not taking the loss – that is what does the damage to the pocket book and to the soul.

41. Never volunteer advice and never brag of your winnings.

42. Of all speculative blunders, there are few greater than selling what shows a profit and keeping what shows a loss.

43. Standing aside is a position.

44. It is better to be more interested in the market’s reaction to new information than in the piece of news itself.

45. If you don’t know who you are, the markets are an expensive place to find out.

46. In the world of money, which is a world shaped by human behavior, nobody has the foggiest notion of what will happen in the future. Mark that word – Nobody! Thus the successful trader does not base moves on what supposedly will happen but reacts instead to what does happen.

47. Except in unusual circumstances, get in the habit of taking your profit too soon. Don’t torment yourself if a trade continues winning without you. Chances are it won’t continue long. If it does, console yourself by thinking of all the times when liquidating early reserved gains that you would have otherwise lost.

48. When the ship starts to sink, don’t pray – jump!

49. Lose your opinion – not your money.

50. Assimilate into your very bones a set of trading rules that works for you.

*** As an advanced trader I do not conform 100% to all the above rules, i.e. rule 46. This is explained in detail in my book.

"Traders with the golden touch do not talk about their success." I avoid Twitter traders who tweet PnL because;

1 Trader

© 1 Trader and jcspe85.blog.com, 2015.

"Traders with the golden touch do not talk about their success." I avoid Twitter traders who tweet PnL because;

1 Trader

© 1 Trader and jcspe85.blog.com, 2015.

Friday, February 20, 2015

from The Complete Turtle Trader

The Turtles’ core axioms

- “Do not let emotions fluctuate with the up and down of your capital.”

- “Be consistent and even-tempered.”

- “Judge yourself not by the outcome, but by your process.”

- “Know what you are going to do when the market does what it is going to do.”

- “Every now and then the impossible can and will happen.”

- “Know each day what your plan and your contingencies are for the next day.”

- “What can I win and what can I lose? What are probabilities of either happening?”

Richard Dennis made his first million by age 25 and $200 million by age 37. He was the lead turtle teacher with a unique view: “Trading was more teachable than I ever imagined. Even though I was the only one who thought it was teachable. It was teachable beyond my wildest imagination.” Great investors conceptualize problems differently than other investors. These investors don’t succeed by accessing better information; they succeed by using the information differently than others.

“I don’t think trading strategies are as vulnerable to not working if people know about them, as most traders believe. If what you are doing is right, it will work even if people have a general idea about it. I always say you could publish rules in a newspaper and no one would follow them. The key is consistency and discipline.”

- Richard Dennis

- Richard Dennis

Subscribe to:

Posts (Atom)